You planned your holiday well in advance and know exactly which tourist attractions you want to visit, where you want to eat and how the public transport system works in the country or city you are visiting. However, even with the most careful planning, unforeseen situations can arise that could ruin your long-awaited holiday. That’s why it’s important to buy travel insurance, which can protect you from unpleasant events.

It provides assistance in the event of problems such as lost luggage, flight delays or cancellations, and even the need for medical care. In this article, we will explain the benefits of travel insurance and how it can help you enjoy your holiday worry-free, safe in the knowledge that you are covered if you need to make a claim.

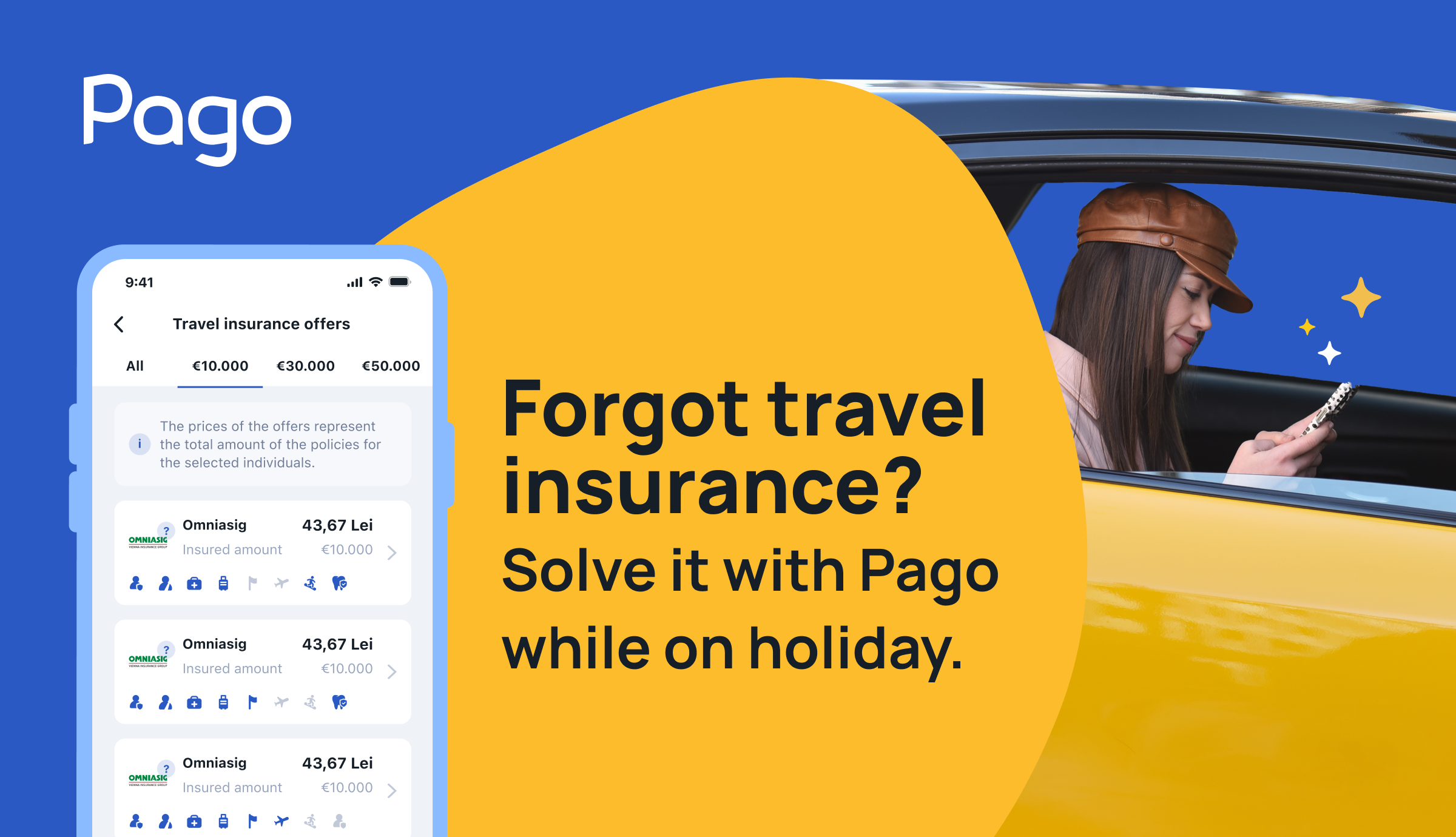

You can quickly take out travel insurance for all family members or friends through Pago at any time. Their details are then saved in your account for future holidays. There are no extra fees, even if you use the free version of the app, and you can easily compare the prices of policies offered by insurers.

This is useful when you leave the country.

- It can be purchased by individuals residing in Romania.

- It is valid in the countries mentioned in the insurance policy and in countries through which you are in transit.

- It must be taken out before leaving the country.

- It is issued only after full payment of the insurance premium.

- It can be taken out for a minimum period of two days and a maximum of 365 days.

Read more details about travel insurance here.

Find out what steps you need to take to benefit from travel insurance:

In the event of an issue, you will require your travel documents, including airline tickets, hotel reservations and receipts for any unforeseen expenses.

Keep all supporting documents in case of lost luggage, delays or flight cancellations.

Notify your insurer about the incident as soon as possible, but no later than 48 hours after it occurred. Follow their instructions to file a claim.

Lost luggage at the airport

One of the most stressful experiences for any traveler is losing their luggage. If you find yourself in this situation, travel insurance can help you in several ways:

1. Reporting the loss: The first step is to immediately report the loss of your luggage to the airport’s lost and found office. You will receive a property irregularity report, which you will need to file your claim.

2. Compensation for costs: Travel insurance usually covers the cost of essential items you need to purchase while waiting for your luggage to be recovered. These may include clothing, toiletries, and other basic necessities.

3. Compensation for permanently lost luggage: If your luggage is not found, the insurance company will provide compensation for the value of the loss, subject to the limit specified in the insurance policy.

Flight delay or cancellation

Flight delays and cancellations can ruin vacation plans, but travel insurance can provide financial and logistical support in such situations:

1. Flight delay: If your flight is delayed by more hours than specified in the policy, the insurance may cover additional costs such as meals and temporary accommodation. It is important to keep all receipts to submit with your claim.

2. Flight cancellation: If your flight is canceled and you cannot reach your destination as planned, insurance can cover the costs of rebooking your flight or, in some cases, provide compensation for your missed vacation.

Medical care on vacation

Another situation where travel insurance is extremely valuable is when you need medical care during your vacation:

1. Emergency medical assistance: If you fall ill or have an accident, travel insurance will cover the costs of medical consultations, hospitalization, and necessary treatments. Depending on the policy, this may also include emergency medical evacuation.

2. Medication and treatment: Insurance can also cover the costs of prescription medication and necessary treatment during your stay abroad.

3. Transport home: In severe cases, insurance can cover the costs of medical transport to your home country, if necessary.

4. Repatriation: Repatriation expenses, including medical transport or repatriation of the body in the event of death, are covered by insurance if the death occurs as a result of an insured risk during the period of validity of the insurance.

Travel insurance is not just a formality, but a safety net that protects you against the unexpected. Whether it’s lost luggage, flight delays or cancellations, or the need for medical care, this insurance gives you the peace of mind you need to enjoy your vacation. Be sure to read the policy carefully and understand what it covers so that you can take full advantage of the protection it offers.